Think of Money as a Tool!

Money is a tool. For many, it’s a personal favorite. And like any tool, you need to take care of it. To add to the tool box and to sharpen the ones you have.

In previous blogs and through my Money book, I have emphasized that money serves three purposes.

1. To spend to meet your needs wants and desires.

2. To save.

3. To give away.

All three of these purposes call for big decisions. To get a hold of your money before it disappears, you will have to decide exactly what you want out of life. That means YOUR life not … your parents, not your children’s, and not your best friend. When you have made that decision, you will find it easier to plan to accomplish what ever goal you are setting.

Your life is your life … it needs to start there. How it flows within the three purposes could include eldercare needs for a relative, kids, and friends. But it is essential that you need to start with you and your immediate goals.

Planning for it can be fun and exciting—yes exciting. Setting a goal, then planning and accomplishing that goal is exciting. How you should spend your money to accomplish your goals needs to always take in your basic money spending essentials: food, shelter and clothing. They are part of the first purpose—the spending on your needs and wants.

How do you learn about the basics? Hopefully you learned from your parents. Unfortunately, many don’t. Could that be you?

There were four children in my family. I was the oldest. When Mother bought groceries, she took all four of us with her. She would send the two oldest to seek and find certain foods that we knew to find. The youngest two trailed along behind learning by watching the older two.

A lot of what I know about shopping, I learned on those shopping trips with my mother.

In my local grocery store one day while I was doing my shopping, I noticed a man shopping with a middle school age boy. The boy brought the man some apples. I assumed the man was his father. He took a look at the apples and said yeah these are good. Now go find us a good mango. And the boy did.

If you have children, shopping can be an excellent way to teach them about money. Helping you make out the grocery list will help them apply math and they won’t even know they’re doing it. You’ll be teaching them skills they will use when they are on their own and for the rest of their lives.

Teach your children how to read advertisements and how to figure out if something is a good buy or not. Even clipping ad coupons brings awareness to them as to what the cost of an apple, or their favorite snack is. The holidays are good time to help your kids learn to read and understand ads. This would be good time to teach them about comparison shopping. With the internet quickly accessible on your mobile, your young shopper can determine if the advertised sale is real a sale or just a lure.

Tools need to be sharpened periodically … for you and your family members. Two sources that I recommend are The Penny Hoarder and Get Rich Slowly. Both websites had many tools that will enhance your money smart quest.

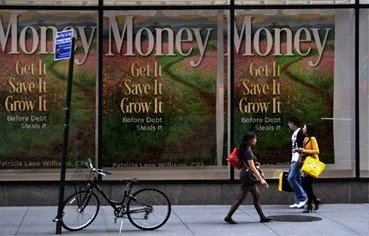

Patricia Lane Williams, CPA has worked with thousands of men and women sounding the warnings. She is the author of the Amazon bestseller, Money: Get It. Save It. Grow It … Before Debt Steals It.

Her website is www.PatWilliamsAuthor.com.